In the world of business and community service, organizations come in two primary forms: for-profit and nonprofit. While both types aim to fulfill specific missions, they operate with distinct purposes, structures, and financial models. This article aims to shed light on the fundamental differences between for-profit and nonprofit organizations.

Difference between a for-profit organization and a nonprofit organization?

1.Purpose and Mission

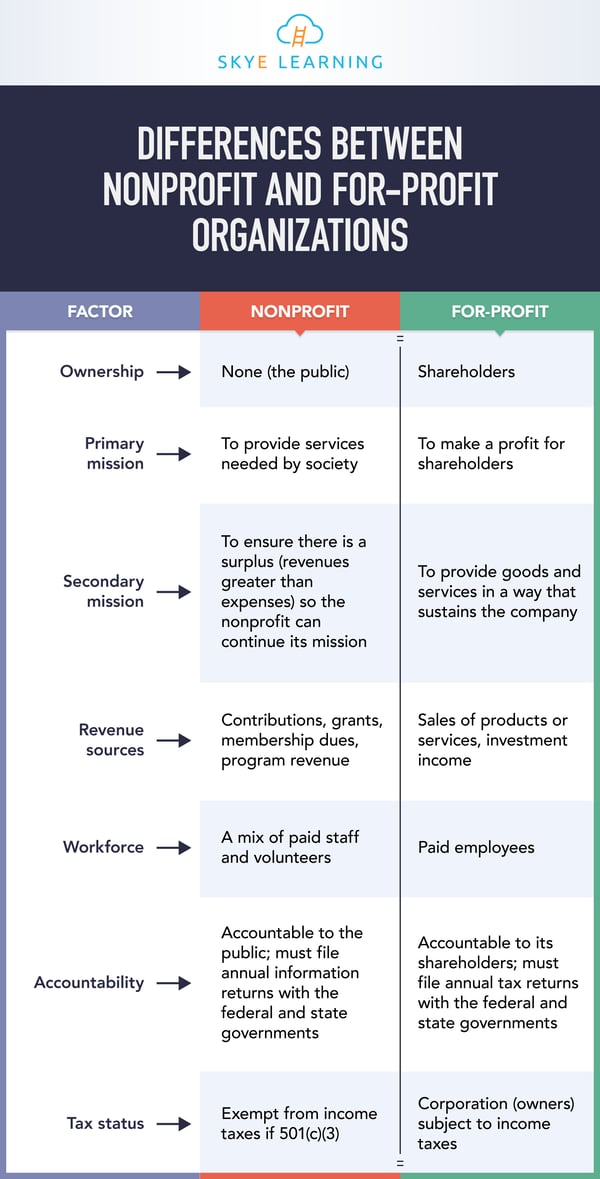

The most apparent difference between for-profit and nonprofit organizations is their purpose and mission. For-profit entities exist to generate profit and financial returns for their owners, shareholders, or investors. Their primary goal is to create value for their stakeholders by offering products or services in the marketplace.

Nonprofit organizations, on the other hand, operate with a primary mission of addressing a specific social issue or serving a community need. These organizations are dedicated to the betterment of society and reinvest any surplus revenue into their mission, rather than distributing it to individuals or shareholders.

2.Profit Distribution

One of the core distinctions between these organizational types is how they handle profits. For-profit organizations are structured to generate profits, and these profits are distributed among the owners, shareholders, or investors in the form of dividends, capital gains, or reinvested to expand the business.

In contrast, nonprofit organizations are not allowed to distribute profits to individuals. Any surplus generated is typically reinvested into the organization’s programs and activities, used to further their mission, or placed in reserves to ensure long-term sustainability.

3.Funding Sources

For-profit and nonprofit organizations rely on different funding sources to operate. For-profit organizations derive their revenue from the sale of products or services in the open market. Their financial success depends on their ability to attract customers and generate profit.

Nonprofit organizations, while they may generate revenue through program fees or other means, often rely on a combination of sources, including donations, grants, and government funding. These financial resources are used to support their mission and maintain their operations.

4.Tax Status

The tax status of an organization is another defining factor. For-profit organizations are subject to income tax on their profits at the federal, state, and sometimes local levels. They do not typically receive tax exemptions, and their shareholders may also be subject to taxation on their dividends and capital gains.

Nonprofit organizations, however, often enjoy tax-exempt status under section 501(c)(3) of the Internal Revenue Code in the United States. This status means that they are exempt from federal income tax, and contributions to these organizations by individuals and corporations are often tax-deductible. This tax advantage can be a significant incentive for donors to support nonprofit causes.

5.Governance Structure

The governance and management structure of for-profit and nonprofit organizations can differ significantly. For-profit companies are often governed by a board of directors who represent shareholders’ interests and make decisions to maximize financial returns. In contrast, nonprofit organizations typically have a board of directors or trustees whose primary responsibility is to oversee the organization’s mission and ensure that it operates in the best interests of the community it serves.

Comparison Chart

| BASIS FOR COMPARISON | PROFIT ORGANIZATION | NON-PROFIT ORGANIZATION |

|---|---|---|

| Meaning | A legal entity, which operates for earning profit for the owner, is known as For-profit or Profit organization. | A non-profit organization is a legal entity, which operates for serving the society as a whole. |

| Motive | Profit motive | Service Motive |

| Form of organization | Sole proprietorship, Partnership firm or company | Club, Trust, Public hospitals, society, etc. |

| Management | Sole proprietor, partners or directors, as the case may be. | Trustees, committees or governing bodies. |

| Source of revenue | Sale of goods and services. | Donation, subscription, membership fee etc. |

| Commenced through | Capital contributed by the owners. | Funds from donation, subscription, government grant and so on. |

| Financial Statement | Income statement, Balance Sheet and Cash flow statement | Receipt & Payment A/c, Income & Expenditure A/c and Balance Sheet. |

| Money earned over and above | Profit, is transferred to capital account. | Surplus is transferred to capital fund. |

Conclusion

In summary, the key distinctions between for-profit and nonprofit organizations lie in their purpose, profit distribution, funding sources, tax status, and governance structure. While for-profit entities aim to maximize financial returns for their owners, nonprofit organizations focus on addressing social issues and reinvesting any surplus back into their mission. Understanding these differences is essential for individuals and businesses looking to engage with or establish organizations in either sector, as it affects their legal obligations, financial considerations, and overall impact on society.

Read More:- How To Start A Community-Based Organization (CBO) In UK

Read More:- A COMPREHENSIVE EXPLORATION OF THE CONCEPT OF LEARNING